Looking to rebuild economic stability after an unpredictable year

Economically, 2022 was a disappointment.

Coming into the year, there were hopes that economic growth would surge following the 18-24 months of Covid-19-related lockdowns. However, given the unprecedented events over the year – specifically Russia’s invasion of Ukraine with the ensuing cost inflation, and the intensity of the ongoing lockdowns in China – it’s no surprise that the year failed to deliver on expectations. A bit of a damp squib in fact.

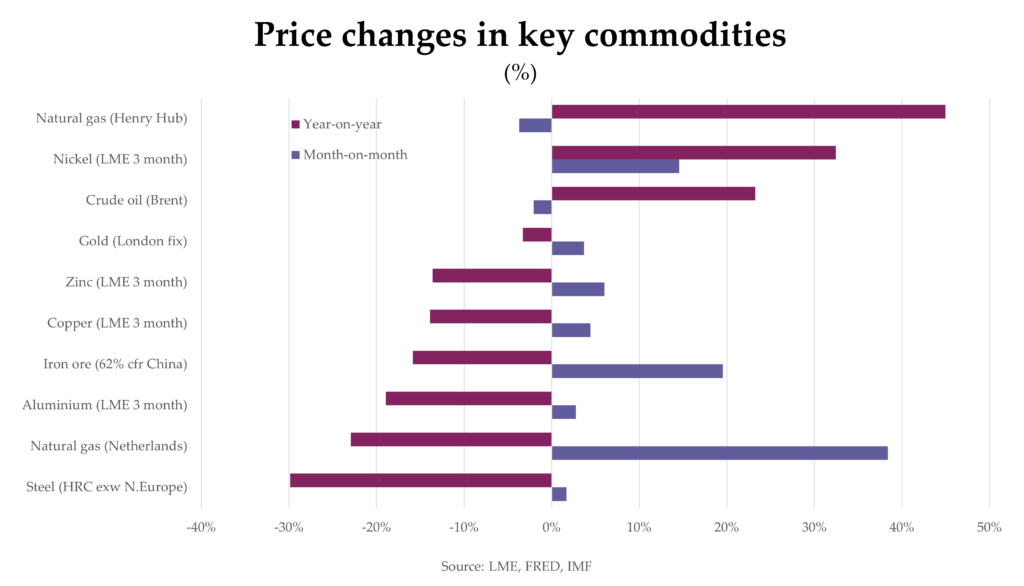

Commodities have felt the full force of the economic buffeting.

Starting the year relatively benignly, several were caught up in global political developments – energy commodities, especially. By year-end, volatility had dropped, and most common commodities were trading towards the bottom of recent price ranges.

Notably, many metals are now down 10-20% year-on-year due to a step down in demand, specifically from the construction industry.

Forecasting the strength of 2023

With activity subdued over the holiday season, many economic analysis firms, consultancies, and NGOs use the relatively quiet period to consider the last year and expectations for the next. This year there has been greater than normal analysis to explain why growth in 2022 stalled – though the conflict and other developments offer clear reasons.

It is with some trepidation that economists are starting to detail their forecasts for 2023. One thing they are aligned on is that 2023 will show weak growth in almost all geographies. Some economies are expected to contract for one or more quarters, with others predicted to enter recessions.

Even China, which provided much support to global growth after the Global Financial Crisis of 2008/2009, is expected to see GDP growth in the range of 2.0-4.5% over the year. Even this is based on the assumption that the Chinese government is successfully dealing with the ongoing construction market debt crisis. If this is fumbled, it would not only undermine Chinese GDP growth, but also depress international financial markets and further subdue global economies.

The OECD has painted the subdued picture common to most forecasts, though these forecasts haven’t yet been updated for 2023. Consumer price inflation is expected to average over 6.5% across OECD countries in 2023. So, GDP growth in many countries under 2% would bring more difficulties for consumers, weaker consumer spending, and a further loss of confidence.

Consumer confidence wanes while business’ holds up

In terms of confidence, there is a clear disagreement between businesses and consumers.

The Composite Lead Indicator (CLI) for both businesses and consumers highlights that businesses are more upbeat than consumers in every country, and usually noticeably.

This is a concern, given that businesses rely on consumers’ confidence to spend. As the CLI’s explanatory notes say, “Consumer confidence indicator provides an indication of future developments of households’ consumption and saving…Values below 100 indicate a pessimistic attitude towards future developments in the economy, possibly resulting in a tendency to save more and consume less”.

The two readings need not match. A business that exports is partly reliant on consumers in other countries, which may explain why China’s Consumer CLI has been running above that of its Business CLI. The trajectories of the pairs of CLI have diverged markedly in most countries over 2022. Noticeably in China, the United Kingdom and the Eurozone, the business CLIs have held up above the long-term average, while those of consumers are showing a lack of confidence.

Consumers can be more easily swayed by short-term effects, such as inflation, while businesses are prone to take a longer-term view and so can look past short-term issues. However, the extended period over which the two readings have diverged suggests a more substantial change afoot. If this is down to unfounded optimism by businesses, it would be cause for concern and point to further growth downgrades, as consumers stop discretionary spending for fear of future economic issues.

2023: No quick recovery, but developing a steadier platform for growth

Headwinds to recovery and growth are undiminished from the end of last year. 2023 is an opportunity to steady the economic ship after the tumultuous past year. Only then can governments look to return regional economies to growth.

The concern is that the poor commercial markets that began in the second quarter of 2020 have so weakened businesses that many will need to be supported in the intervening years, and that the path to recovery will then be risky, lengthy, and costly.

JASON KAPLAN

Director (Special Projects)

Jason Kaplan has been analysing commodity markets and forecasting developments for more than 20 years. He combines a keen understanding of commodities, the commercial drivers of companies along the supply chain, and the effects of macroeconomic factors to predict how markets will develop.