Commodity prices lifted by supply cuts and China demand surge

The past three months have seen commodity prices jump, despite a troubled backdrop of rising Covid-19 infections and increased political tensions in the US around race relations and the upcoming Presidential election.

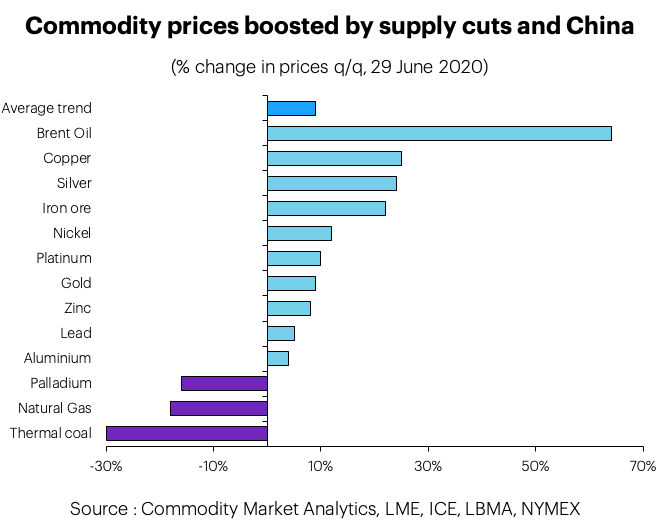

Brent oil led the way higher with a 64% rally in Q2, followed by copper and iron ore, up 25% and 22% respectively. Gold also pushed up towards multi-year highs with a 9% increase.

Few would have expected this widespread rally given the economic crisis that gripped the world economy back in March/April, as lockdowns froze economic activity in many parts of the developed world.

It’s important to realise that both supply and demand have been on a roller-coaster ride through Q2, which has resulted in wild swings in prices, as producers and consumers have both reacted to the global pandemic.

Overall, the recent bounce in prices may well extend into early Q3 given current momentum. Still, volatility is likely to remain high, and we expect copper to outperform both oil and gold.

Ultimately, we expect fundamentals to drive relative price performance, even though correlations between financial markets and commodities will remain elevated due to ample global liquidity, driven by quantitative easing and the world’s largest central banks.

Oil prices led the way up in Q2, with Brent prices reaching US$40pb by the end of the quarter, which was a dramatic bounce back from low levels seen in late April. WTI prices even turned negative at one point in April, meaning that producers were paying to get rid of unwanted oil in the US, amid a savage price war between Russia and Saudi Arabia.

The global oil industry was in an awful position in terms of fundamentals, but the main positive takeaway was that the situation was unsustainable for any length of time.

Supply quickly reacted to address the global glut. In May the OPEC+ group slashed production by around 10% of the world total, and they promised that cutbacks would extend well into the future. Most other major oil producers were also forced to react to low prices and poor economics, with Canada and the US implementing cuts and seeing significant numbers of bankruptcies.

Meanwhile, oil demand has been recovering, particularly in China, which is helping to support prices. While the worst is probably over for oil, the industry will be overshadowed for the next few years by weak demand and an overhang of recently mothballed capacity. The upside for prices looks limited.

Copper, on the other hand, looks better placed to benefit in the months ahead from the improvement in global economic activity that is coming through.

Copper’s exposure to China is a benefit at the moment because the country has recovered earlier and more strongly than places like Europe and the US. Amazingly, car sales and electricity consumption in China were up by 10% and 5% y/y in May, showing a strong bounce back from the weakness seen in February. By contrast, North American truck production was down by 76% y/y in May.

Furthermore, the virus has now started to sweep through the key mining areas for copper, which has meant that supply is now being challenged at a time when demand is improving, creating a disconnect between these two drivers.

Most significant has been the problems in Chile. Some miners have died, and virus cases have been spiralling higher in the country. In June, this forced Codelco to suspend operations at Chuquicamata, its second-largest mine. Peru is also struggling to restart mines which have been mothballed due to the virus, impacting copper and zinc output.

In conclusion, this year has, unsurprisingly, been an extremely volatile one for the world economy and the major commodity markets.

While prices have bounced back strongly from the low levels seen in April, this masks some important dynamics. Oil’s supply cuts have addressed the immediate global glut in the industry, but long-term fundamentals still look very weak from a supply and demand perspective. On the other hand, copper is currently riding a wave of excess global liquidity and a strong bounce back in Chinese demand, which should create significant tailwinds heading into the remainder of this year and beyond.