Commodity records tumble as OECD demand accelerates

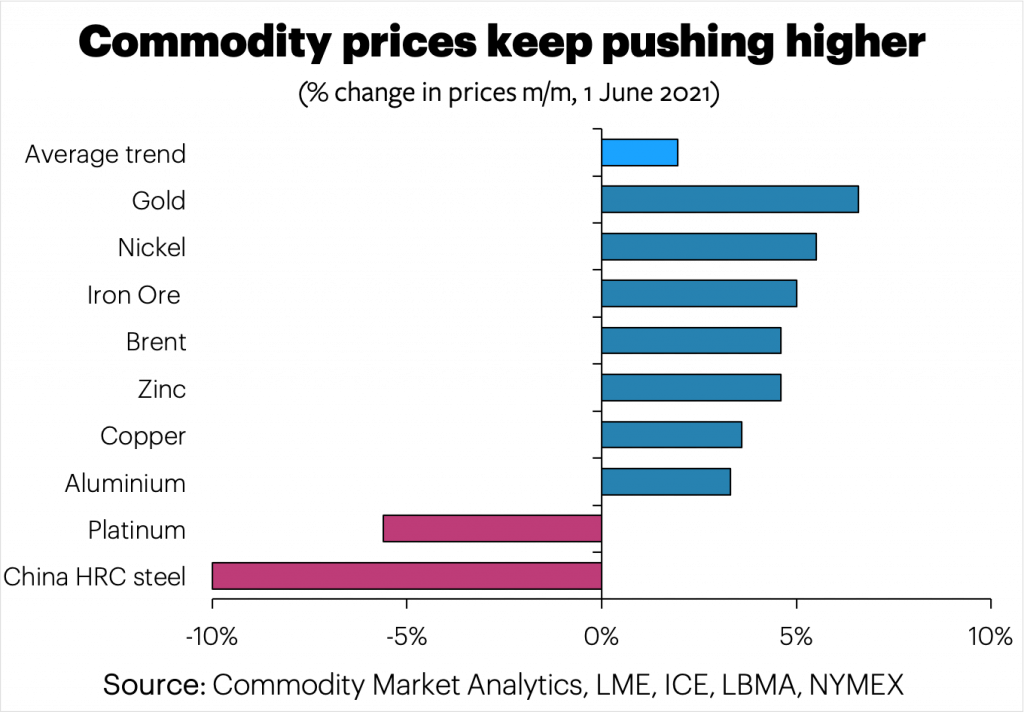

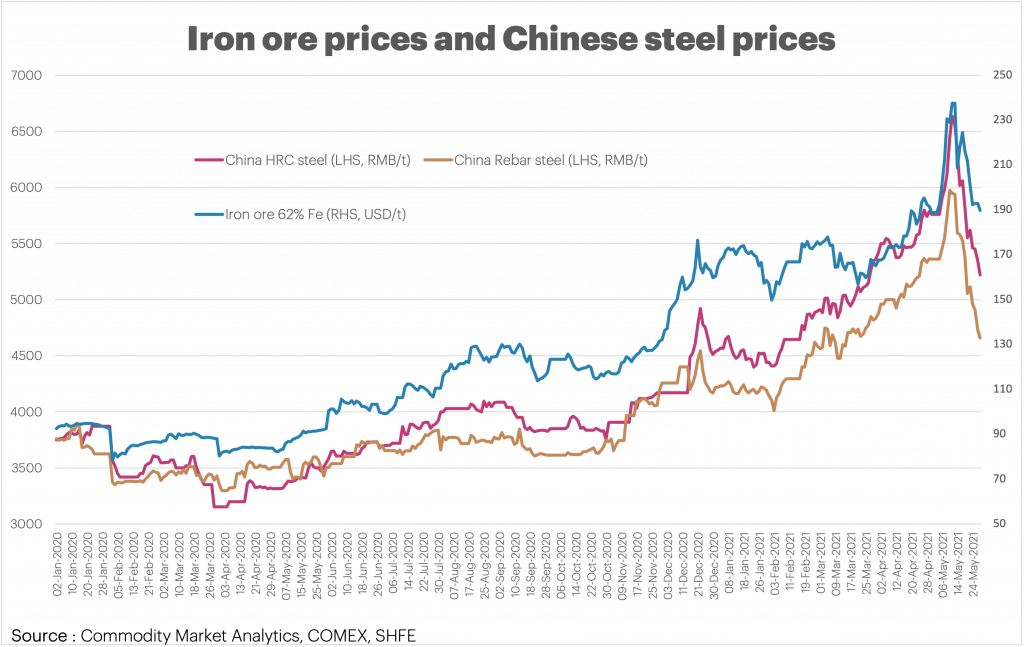

Commodity prices continued to climb in May, with rallies seen in the base metals, gold and crude oil. Iron ore was also higher, but it had a bumpy ride, with prices up sharply early in the month before pulling back. The lifting of lockdowns in the OECD area and persistently strong demand from China have boosted global commodities demand.

However, while physical demand is undoubtedly growing strongly in many markets and areas, there are clear signs of bubbles developing. Speculative activity is also playing a role in taking prices higher in China and the rest of the world. Copper, iron ore, palladium, US steel and US timber prices all reached record highs in recent weeks. Across a broad spectrum of 25 major industrial commodities, the average increase in prices was 95% y/y by the end of May.

OECD investors are looking to buy hard assets as a protection against inflation. Citigroup notes that commodity assets held by fund managers reached US$648bn in April – a fresh record high. Given that US core personal consumption expenditure (the Fed’s preferred measure of inflation) reached 3.1% in April – which was the highest since 1992 – investor concerns are understandable.

Moreover, China is getting worried about froth in its markets and the impact of high prices on its manufacturing sector. Factory gate prices in April jumped by 6.8% – their fastest increase in three years. In May, the country’s economic planning body said it would crack down on hoarding and monopolies in commodities. This helped to bring down domestic prices in the second half of the month.

The drop in Chinese steel prices was particularly striking, with HRC and rebar prices down by over 20% in the second half of the month, showing the power of government intervention. The Chinese government has wide-ranging powers to intervene in financial markets and alter the underlying drivers of supply and demand should it see this as necessary.

Credit conditions are also being tightened in China, supporting the idea that slower economic growth is coming. According to Oxford Economics, GDP growth will slow from 8.9% in 2021 to 5.5% in 2022. The first quarter saw a surge in bank loans as the government was keen to stimulate activity, but new bank loans fell by more than expected in April, and money supply growth fell to a 21-month low. This reinforced slowdown fears.

Looking ahead, global demand looks set to remain strong, but we expect prices to face stiff headwinds, and the supply response will largely determine where commodity prices go next.

Iron ore looks particularly vulnerable to a setback as many of the challenges for producers are temporary. China is trying to slow down steel demand and boost the proportion of scrap used in the steel mix at the expense of iron ore.

The upside for oil is also becoming increasingly limited. While prices are low in relative terms compared to copper and iron ore, this appears to accurately reflect the ample amount of spare capacity being held back by OPEC. So far, OPEC appears to have reached a happy medium of prices that are good enough to restore decent levels of profitability but not high enough to encourage the US tight oil sector to change its mindset and accelerate drilling and production. Another leg higher in prices is likely to upset this delicate balancing act.

Dan Smith – Director, Special Projects