Energy prices surge in Q3, but China concerns overshadow metal markets

After a solid start to the year, September proved to be a turbulent month for financial markets and commodities.

Supply chain bottlenecks and microchip shortages have become widespread, fears about inflation are rising, and sentiment in China is overshadowed by worries about a potential debt default by Evergrande – the giant Chinese property firm. Meanwhile, the US stock market dropped by 5% in September – its largest fall since February 2020.

Commodity markets were caught between strong demand in the OECD area and a slowing China, creating significant winners and losers.

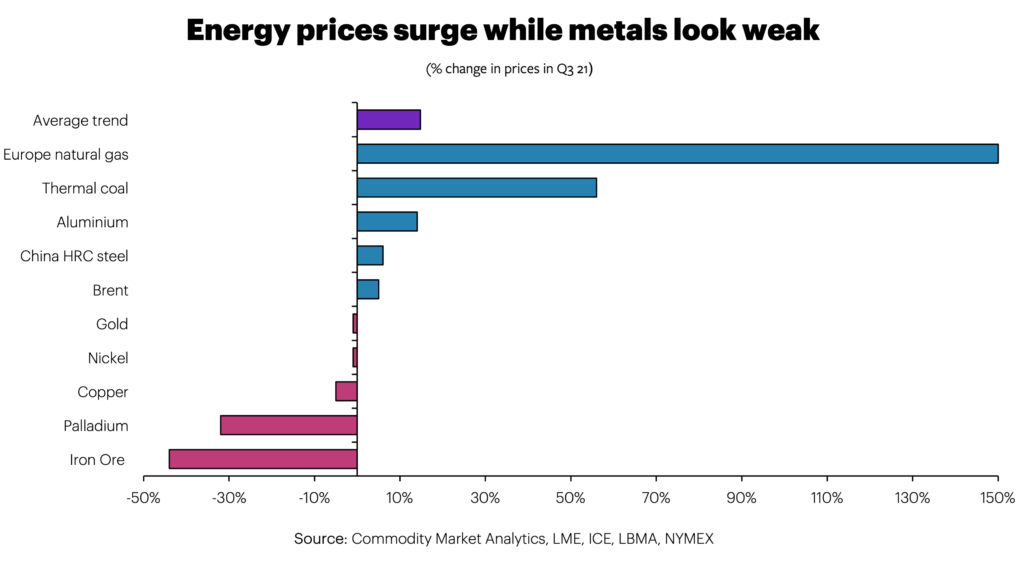

Natural gas and thermal coal prices jumped by around 30% m/m in September, with Brent oil up 7% m/m. However, metal markets trends were bearish, reflecting a strong US currency and lacklustre demand from China. Iron ore prices dropped by 25% m/m, with copper down 6% and gold down 3%. For the third quarter, there was a massive divergence, with natural gas prices in Europe up 150%, while iron ore was down 44%.

China is struggling amid electricity shortages and a power crunch due to coal shortages. The official manufacturing PMI fell to 49.6 in September from 50.1 in August. Chinese steel production was down 13% year-on-year in August, and provisional data suggest another 8% fall in September. The construction market is a significant consumer of steel, so fears about the potential collapse of Evergrande are making steel consumers nervous.

While other parts of the economy are holding up better than steel, the general trends in other markets such as cement, electricity, and crude oil processing suggest a weak growth picture in recent months.

The OECD countries have a different problem.

Growth is rising rapidly against a backdrop of reduced capacity after the Covid crisis, helping to fuel inflation and adding to the pressure on central banks to reduce monetary stimulus.

The Eurozone is seeing significant inflation, with the 3.4% year-on-year increase in CPI in September, above the central bank target of 2%. However, rising energy prices explain a big part of this, and the ECB is still assuming that inflation pressure will ease in the months ahead. Similarly, in the US, core CPI is running at 3.6% in the 12 months to August. This was the same pace as in the year to July, which provided some hint that a peak may be close.

Nevertheless, rising energy prices have the potential to derail the current recovery, as they feed through into higher prices for manufactured goods through their impact on operating costs.

Compared to a year ago, Brent prices are up 92%, Australian thermal coal is up 210%, and European gas prices are up by 380%.

Despite these concerns, it looks like global economic activity will remain buoyant for the next few months, so the million-dollar question is will supply be able to react to higher prices?

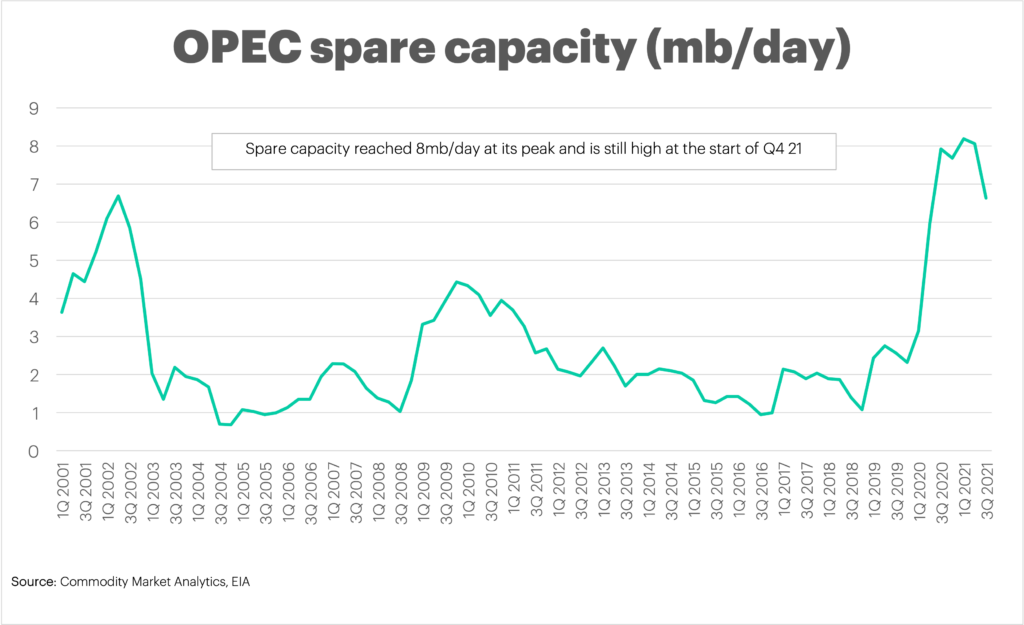

For oil, there is not a structural shortage of supply. OPEC+ continues to withhold a significant amount of capacity from the market, and there seems a good chance that the cartel will act soon to rebalance the market. Recent indications from core OPEC members support the idea that the group would like to see prices in the range of USD 70-80pb to avoid damaging the long-term prospects for demand. The upside for oil prices looks limited given that the OPEC+ group produces 44% of world output.

Similarly China is the world’s biggest producer of coal, and it can easily boost supplies if energy shortages need to be addressed. Restarts are already underway at 15 coal mines, as the need for energy security outweighs concerns about reducing emissions.

Gas is more challenging to predict as the outlook is dependent on the weather and factors such as Russian pipeline shipments. However, even here, there have been some temporary factors holding back supply, including problems at US producers, the world’s biggest gas producer, impacted by Hurricane Ida. These should be resolved soon. Once the northern hemisphere winter is over, supply should catch up with demand, pushing prices lower once more.

Overall, high energy prices give producers a clear incentive to switch back on the taps as soon as possible. With plenty of spare capacity, oil and coal prices look set to fall back soon, easing concerns about inflation, although gas prices look set to remain elevated until we pass the peak of the winter.

Dan Smith, Director – Special Projects