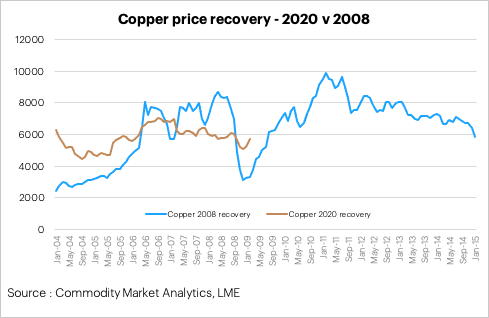

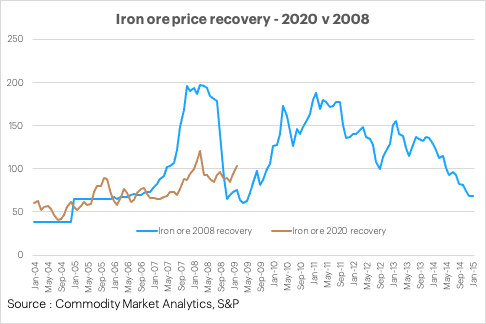

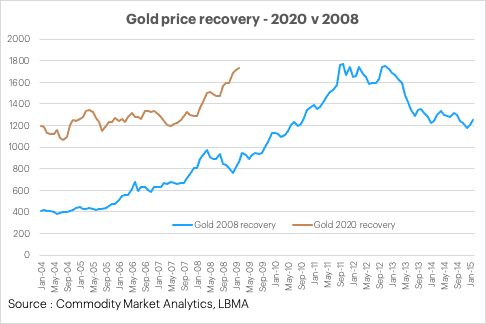

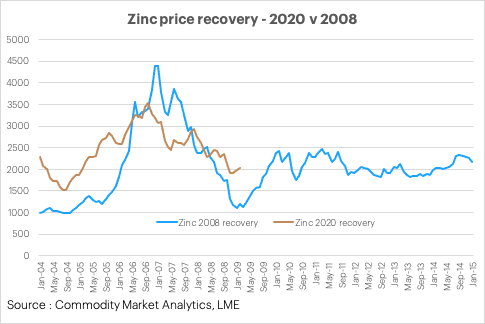

The past few months have seen many commodity markets rally strongly from their recent lows, as coronavirus lockdowns have eased across nearly all countries.

During Q2 copper prices rose by 24%, iron ore by 17% and gold by 10%.

While the most recent economic data is still poor, this very much reflects a backwards-looking view of Q1 and early Q2. More important is that the first green shoots of the economic recovery are starting to show through in some key areas, amid a strong bounce back in activity and commodities demand.

Prices and inventory levels still look low by historical standards, suggesting that upside risks remain significant on a multi-year view. In this blog, we highlight reasons for bullishness and optimism, despite the backdrop of continued Covid19 challenges.

Ultimately it is the economic cycle that will drive both metals demand and prices in the years ahead. On this front, there are many reasons to think that April will represent the low point.

What has been most impressive has been the V-shaped recovery that has taken place in China. The country went into lockdown in January, which resulted in a weak Q1, but Q2 is likely to show not just a rebound from a low level, but a remarkably quick return to positive y/y growth.

Electricity consumption, for example, rose by 5% y/y in May and car sales surged by 15% y/y in the same month, forcing some leading economic forecasting firms to revise up their gloomy outlooks. This idea of positive surprises was reinforced by China’s non-manufacturing PMI for June, which reached 54.4 in June, up from 53.6 in May.

One reason for the rapid turnaround in China and the world’s other major economies is that the ending of lockdowns has released pent-up demand, helped by consumers that have been able to continue working from home and have been forced to build up savings. Furthermore, governments have acted quickly and decisively to help the jobs market.

At the same time, central banks have pumped record amounts of money into the economy, providing a massive wave of liquidity to buoy financial markets and reduce the risk of another credit crunch. US money supply measured by M2 grew by a record 23% y/y in May, beating the April growth rate of 18%, which was itself a record.

The recent upswing in commodities demand is more difficult to measure directly, but the early signs from China are again promising.

Chinese imports of crude oil surged in May, up 19% y/y, another all-time high, pointing to restocking and strong local demand. Indicators from the metals sector also showed double-digit growth in output of fabricated copper, aluminium and steel rebar in the same month. For the mining sector, this has become a significant engine of growth once more after a brief lull.

Admittedly, in terms of supply-demand balances, the base metals are going to be oversupplied this year, but the disconnect between supply and demand has not been that large. Partly this is because the weakness in demand has been short-lived and supply has also taken a hit from coronavirus-related shutdowns. The copper and zinc markets, for example, will be oversupplied this year because of lower demand, but both are likely to swing back into deficit in 2021 and beyond.

It is notable that unlike 2008/2009 there has not been a widespread surge in metal delivered to exchange warehouses, consistent with the idea that this time around compensating early adjustments have been made to supply and credit remains relatively abundant. Copper exchange inventories are currently down by a third from where they were last year, and zinc is down by more than 50% from its 2016 level.

Iron ore remains another area of surprising strength. A combination of strong demand from China and virus-related supply challenges in Brazil has resulted in a significant drawdown in port stocks and have helped to create a bullish narrative.

Chinese steel production is now firmly back on a growth path – up 4% y/y in May and weakness in other countries is starting to bottom out. Government spending tends to boost end-use sectors such as construction and infrastructure, both important areas for steel and base metals such as copper and zinc, so this will provide significant demand support.

The major mining markets continue to face significant headwinds from Covid19 challenges at the start of Q3.

Still, the more positive developments in fundamentals highlighted above mean that prices should be well-supported on a multi-year view, with copper and zinc likely to outperform.

Dan Smith, Director Special Projects