Commodity markets edge higher, as lockdown pain starts to ease

In the past month commodity prices have moved up, with traders and analysts still fixated on latest developments with Covid-19. Progress or setbacks with controlling the virus will inevitably drive the economic and demand cycle in the weeks and months ahead.

What is becoming clear is that virus-related lockdowns have lasted for around eight weeks in most countries, so we now appear to be passing ‘peak lockdown pain’ and entering the early stages of economic recovery in Europe. Germany, for example, started to lift restrictions in late April and some students returned to school on 4 May. The US is following closely behind, despite the country still suffering from high levels of infection.

The main risk for the world is the feared second wave of infections, which could cause more setbacks in the second half of this year. On balance though, prices look set to drive prices higher from here, although volatility is likely to remain elevated.

The economic data has been extremely weak, but it’s important now to look ahead

Recent economic data and leading indicators were alarmingly bad – in many cases showing the most substantial drop in decades. Chinese GDP for Q1 was down 7% – the first fall since the series began back in 1992. Meanwhile, the US was down 4.8% in Q1, and the Eurozone was down 3.8%, even before the full force of lockdown measures were felt. Worse can be expected in Q2.

However, financial markets are buoyant as they look ahead to the recovery. Leading economists expect a decent bounce back in China in Q2, with 9% growth on the cards. For the full year, there should still be modest growth.

This is bullish news for any markets tied to China and for countries that trade with it. More recent high frequency and survey data support the idea that China has rapidly got back to normal in some key areas. Urban road congestion in late April returned its pre-crisis peak, and property sales are now significantly above January levels. The Caixin China manufacturing PMI was 50.1 in March and 49.4 in April, which points to a stable economy, after a weak February.

Outside China, there is still some way to go. April is probably going to be the worst month of the year for the rest of the world. The Eurozone composite PMI fell from 29.7 in March to 13.5 in April (below 50 indicates contraction), indicating the steepest fall in activity ever recorded. The UK appears to be in even worse shape. Car sales fell by 97% year on year in April, showing the depth of pain felt by some sectors.

The virus has hit miners in many countries, helping to limit supply

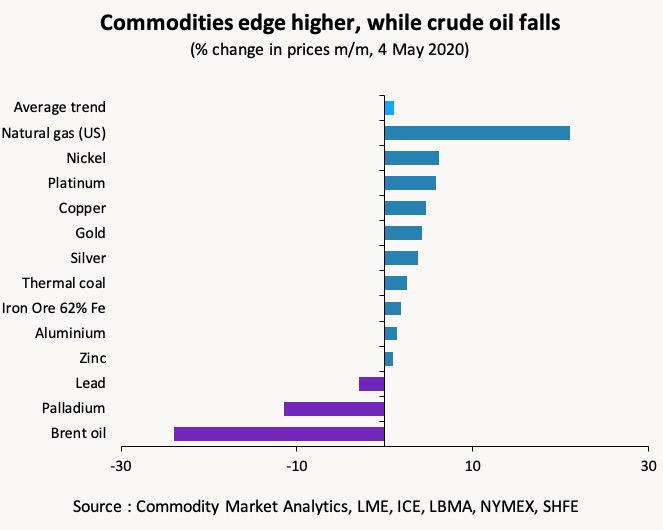

Despite the gloomy backdrop, the past month has seen the commodities complex edging higher overall. As the chart above illustrates, the most significant gains were in US natural gas, nickel, platinum, copper and gold. Oil was a notable exception and was down sharply once again, despite a wave of supply cuts taking place.

While many markets still look oversupplied, traders (outside oil) are now focussed on what the second half of the year will look like given the likelihood of a strong bounce back in economic activity and massive government stimulus.

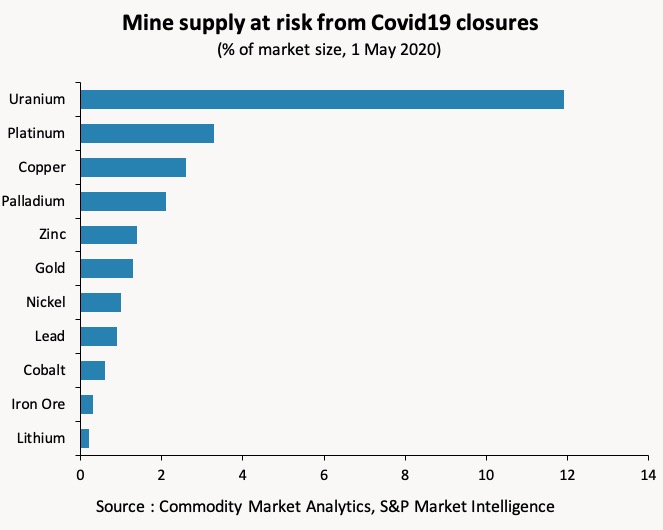

In the mining sector, there has been a lot of talk about producers cutting output due to coronavirus restrictions, and this is helping to underpin sentiment and prices. According to a report from Standard & Poors Market Intelligence, 265 mines have been impacted by coronavirus related shutdowns in the early part of this year. Miners in Canada, Mexico, South Africa and the US were the worst affected, and mines were expected to close for around 40 days on average, taking a big chunk out of the supply-side. In terms of the impact on fundamentals, the mines closures are significant, but generally small compared to the threat to demand.

As the chart below illustrates, in the case of copper, platinum and palladium around 3% of mine production is under threat. Uranium is a notable exception with 12% of global production challenged, as mines in Kazakhstan, the world’s biggest producer, are suspended for 90 days.

Throughout April, miners pressurised governments to make them an exception during lockdown. And in many cases, this has worked. In mid-April South Africa announced that mines could reopen at 50% of capacity. In Canada, the majority of mines have reopened at the same time, as the Quebec government has declared them to be an essential service. Overall mine closures have helped to tighten some oversupplied markets.

Still, demand remains the key trigger for price trends as we move into what could be an explosive recovery phase for some markets, where supply restrictions dovetail with a strong demand upswing.

Dan Smith, Director – Special Projects