Commodity prices regain lost ground, despite weak signals from China

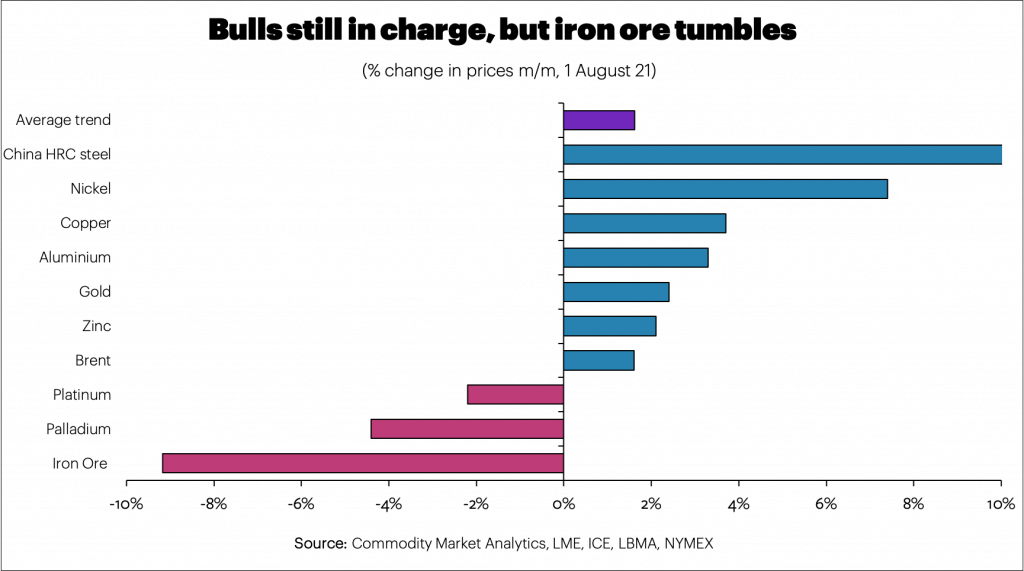

After a brief wobble in June, commodity prices regained strength in July. Nickel and Chinese HRC steel led the way higher with gains of 7% and 11% m/m respectively, with copper and gold also buoyant. Brent was little changed as OPEC started to boost supply to meet improved demand. Iron ore was a notable exception, and prices tumbled.

Markets are being buffeted between a bearish perspective from China and a bullish view from the OECD. Continued low interest rates and a strong rebound from lockdown measures are fuelling this bullishness. The sentiment is not surprising, given the US Fed downplayed expectations that the boost from monetary stimulus would be withdrawn any time soon.

Markets bought into this bullish story, with the S&P500 Equity Index up 3% in July, helped by strong corporate results. By the end of July, earnings growth for the Index was on track to reach its highest level since 2009, with 88% of companies beating cautious expectations. Traders expect earnings to rise 78% y/y in Q2, with net profits also buoyant above 12% for a second quarter.

Corporate results from the mining sector were also bullish for iron ore prices. BHP reported that iron ore output was down 2% y/y in Q2, mainly due to a pullback at its Western Australian operation.

Rio Tinto suffered even more, with shipments down 12% in Q2 at Pilbara. Problems included high rainfall in Australia, a lack of capacity at a processing plant, and challenges related to cultural heritage management.

Finally, Vale revised its expectations for year-end capacity from 350 million tonnes (mt) to 343mt.

Copper

For copper, the story was more nuanced. BHP reported that output was down 3% y/y in Q2, reflecting weakness at Escondida, which more than offset expansions at Antamina, Olympic Dam and Pampa Norte. Similarly, Rio Tinto reported a 13% drop in copper in Q2.

The company also noted challenges at Escondida as well as a slope failure at Bingham Canyon. However, Freeport is moving in the opposite direction, with a 22% y/y boost to copper sales in Q2. This reflects the ramp-up of underground operations at Grasberg and a higher operating rate at Cerro Verde.

However, the picture from China looks more bearish, with the Shanghai Composite equity index down 5% in July, reflecting domestic concerns about slowing corporate profit growth and fears about a weaker economy. The official manufacturing PMI slowed to 50.4 in July from 50.9 in the previous month.

Iron Ore and Steel

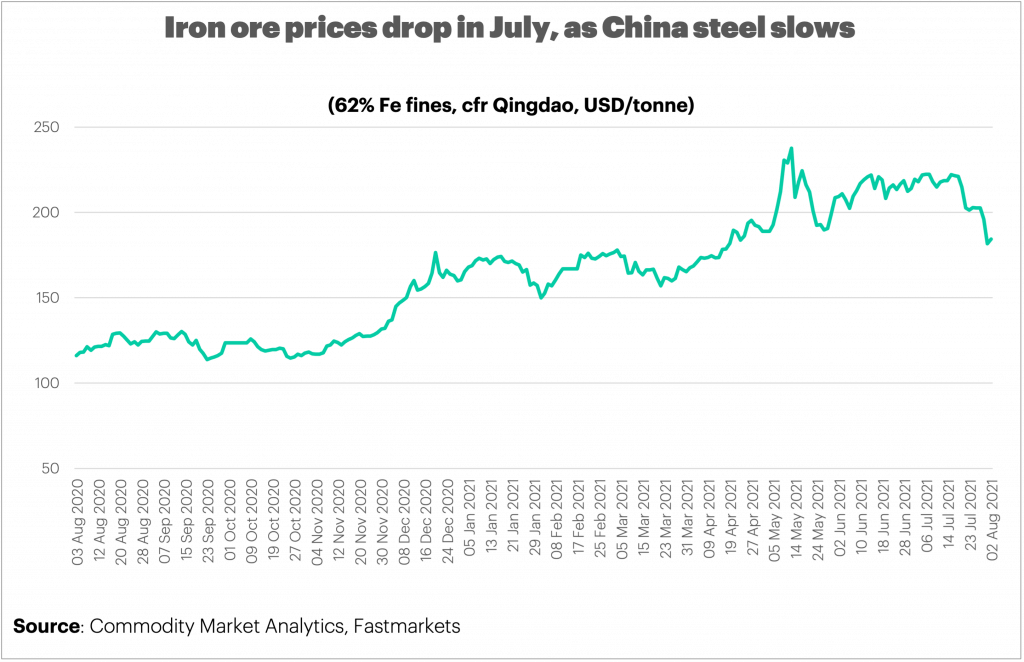

Iron ore prices also tumbled in late July, according to Fastmarkets. While iron ore production at the major mining companies has been constrained, this has failed to offset fears about weak demand from the steel sector in China in the remainder of this year.

Local traders noted rumours of the imposition of tough restrictions over the winter period. The Chinese government wants steel production this year to be no higher than last year, which would imply an output level of around 500mt in H2, an 11% drop from H1. Steel output in June was 94mt, down 6% from the previous month. Y/y growth in June was just 1.5%, compared to an increase of 12% in H1.

Overall, we continue to believe that the risks for many commodity prices are to the downside. While commodities demand is improving rapidly in the OECD area, China remains a driving force for fundamentals, and here a slowdown seems to be taking hold.

Iron ore prices look vulnerable to further weakness, and copper is likely to struggle amid a bearish backdrop for Chinese metals and mining in H2. Steel prices look set to remain elevated, though, as output cuts help to offset falling input costs.