Commodity markets have experienced extreme volatility in the first quarter of this year as the coronavirus create an unprecedented demand shock. Oil markets were also rocked by a simultaneous price war between Russia and Saudi Arabia.

In terms of the macroeconomic story, everything is being driven by virus-related shutdowns. But it is important to recognise that the world is on three main paths heading into early Q2.

China

The first path is being forged by China, which is quickly pulling out of its slump. The country led the way down in January and February but is now clearly recovering.

One of the best general gauges of economic activity is thermal coal consumption, which tells us how much electricity is being consumed.

The daily data available for this suggests that in early April the economy was still subdued, but activity is rapidly getting back to normal as restrictions are lifted.

This idea was supported by official manufacturing PMI data which rose from 35.7 in Feb to 52 in March. In mid-April, there is a release of a mass of data on the economy, including trade and GDP, which will give us a better guide to how things are going.

Europe

The second path is being followed by Europe, where talk is turning to exit strategies and the best way to get back to normal quickly.

In terms of the economic data, the Eurozone manufacturing PMI fell from 49.2 in February to 44.5 in March. It is quite likely though that April will be worse as it will show the full force of virus-related restrictions.

Key consuming areas for mining look much weaker though, so UK car sales were down 44% year on year in March, and the Eurozone construction PMI fell from 52.5 in February to 33.5 in March.

One key issue to follow is to what extent will unemployment rise in the weeks ahead. Many European countries are massively boosting government spending to avoid a prolonged slump, but it remains to be seen whether this will work.

The US

The third path is being taken by the US, which still appears to be heading into the worst of the storm, as infection rates are rising rapidly.

Most alarming from an economic perspective was the recent jump in claims for unemployment benefits. In previous recessions, this reached a peak below 0.7m per week. But claims rose to 3.3m on 21 March and then exceeded 6m in late March and again in early April – nearly ten times the previous peak.

Given that the US remains the world’s largest economy, a deep recession in the country still has the potential to drag down the rest of the world into a prolonged slump and is worth following closely in the weeks ahead.

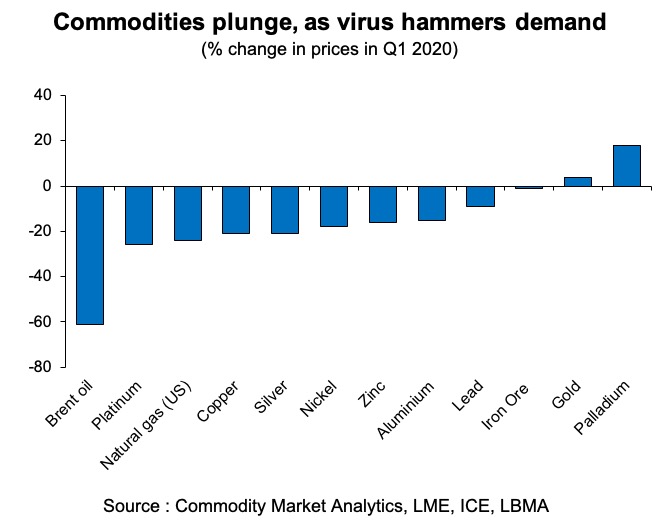

Commodities price trend in Q1

Turning to the commodity markets, there were significant falls across the complex in Q1, with Brent oil down by 61%. We also saw double-digit falls in many other markets, including base metals and platinum. The main exceptions were gold and palladium, with palladium up 18% in the quarter.

In terms of oil, the views of leaders in Russia and Saudi Arabia have diverged on the best way to react to the downturn, and the OPEC+ group fragmented in March leading to a brief, vicious price war. Brent oil prices plunged from above USD 50pb back in early March to around USD 25pb in mid-March, before recovering in early April.

It now appears that the OPEC+ group has agreed a 10mb/day cut in output at its Vienna meeting (10% of global supply), which would be the most substantial cutback ever agreed by the cartel. The problem is that this may still not be enough given that around 65% of oil demand is transport-related and activity in this sector has frozen in many countries.

The other reason why this is not particularly bullish is that this now represents a massive cushion of spare capacity, which will overshadow the market for the foreseeable future.

The prospect of oil prices getting back above USD 50pb any time soon seems remote.

Dan Smith, Director – Special Projects