COPPER POWERS AHEAD WHILE GOLD SLUMPS

Financial markets surged in November, as the US election was won by Joe Biden without too many fireworks, and dramatic progress was made with several vaccines for Covid 19, boosting growth expectations for 2021.

Global equity markets rose by the greatest amount since records began, with the FTSE All-World Index up 9% in November and the S&P500 up 11% for the month.

Commodity markets also moved quickly to price in the new reality, with oil prices surging and double-digit gains for copper, platinum and zinc. On the other hand, safe-haven buying of gold reversed, and prices fell by their most in four years.

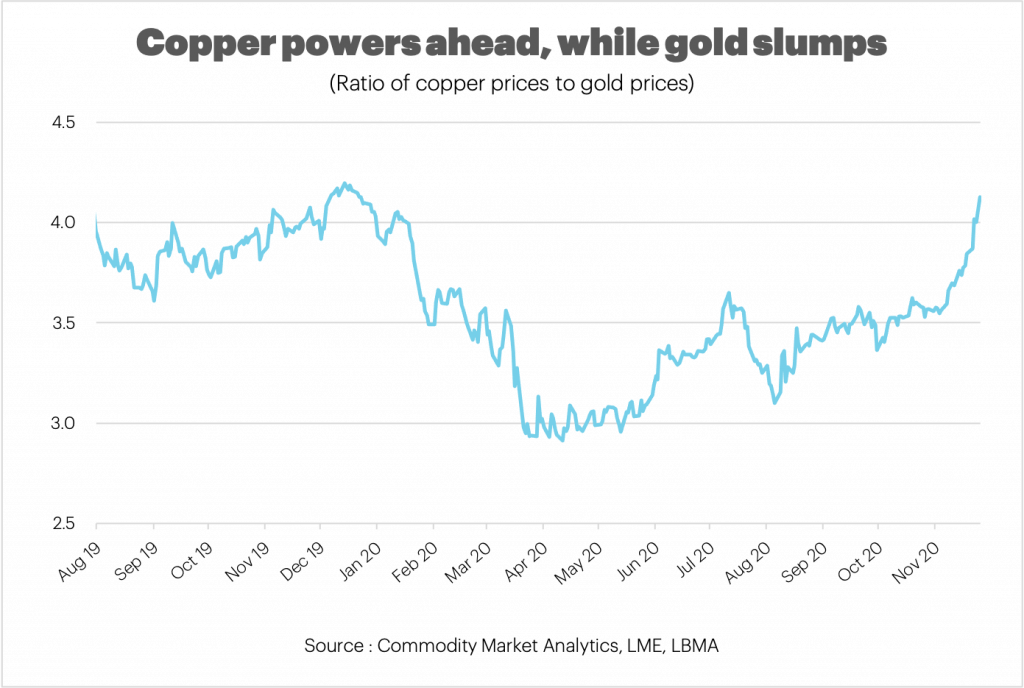

The rout in gold prices in November reminded investors that the bullish narrative is now clearly under threat, despite a backdrop of very low interest rates and a weakening USD. As we show in our chart, there has been a marked divergence between copper and gold prices in recent months. Copper’s relative strength has meant that the copper:gold ratio has surged above four for the first time since January 2020.

Investors had been buying gold heavily in the period from March to July, with purchasing of physical gold ETFs tracking broader appetite for the ultimate safe-haven asset. Inflows into gold ETFs averaged a hefty 150 tonnes(t)/month during these five months.

However, the three months that followed saw this buying dip to just 42 t/month, warning that the initial panic was starting to fade. Finally, November saw a reversal, with significant selling from mid-month and net sales for the full month heading for around 80t.

Gold can offer significant benefits to investors who wish to diversify, but today does not look like an attractive buying point, and we are likely to see key support levels tested in the weeks ahead. The recent break below US$1,850/oz suggests a target of US$1,625/oz is on the cards, which would represent a substantial 22% drop from the record high seen in August.

SCOPE FOR A RECOVERY IN OIL

By contrast, oil prices jumped in November. While the market fundamentals are still poor, a lot of this bad news has already been priced in. Easing of lockdowns in Europe and the US mean that travel looks almost certain to rebound strongly in the year ahead, helping to take oil demand higher.

There is certainly a lot of scope for recovery given that the IEA expects an 8.8mb/day drop in demand this year. Also, Brent oil prices are still 24% down on where they were a year ago, possibly suggesting more significant upside potential than a market like gold which is still up 19% y/y.

There does not seem much doubt that oil demand will bounce back from here, but oil prices still face significant headwinds, as spare capacity is substantial. This capacity comes from two main areas – the OPEC+ group and the US.

The OPEC+ group agreed to cut output by 9.7mb/day back in April in response to weaker demand and is now trying to find the best way to return to normal. So far supply increases have been modest, with cuts easing to 7.7mb/day this quarter and then due to ease further in Q1 2021.

It looks like the cartel will slowly adjust output upwards, as the demand recovery comes through. A final decision will be made at the OPEC meeting in early December (delayed from 30 November). The group also needs to accommodate a big jump in output from Libya, as the political backdrop has improved. Iran offers another challenge, as a less aggressive US administration could allow more oil to be pumped, pushing the market back into oversupply.

Looking ahead, gold appears to face the greatest challenge among the major commodities, and the recent price rout could easily extend in the short-term. Oil, on the other hand, could rally further from here, riding the back of the demand recovery. Much will depend on unpredictable events, such as US and OPEC politics and progress with lifting travel restrictions.

Dan Smith, Director – Special Projects