Commodity markets tumble in June on recession fears

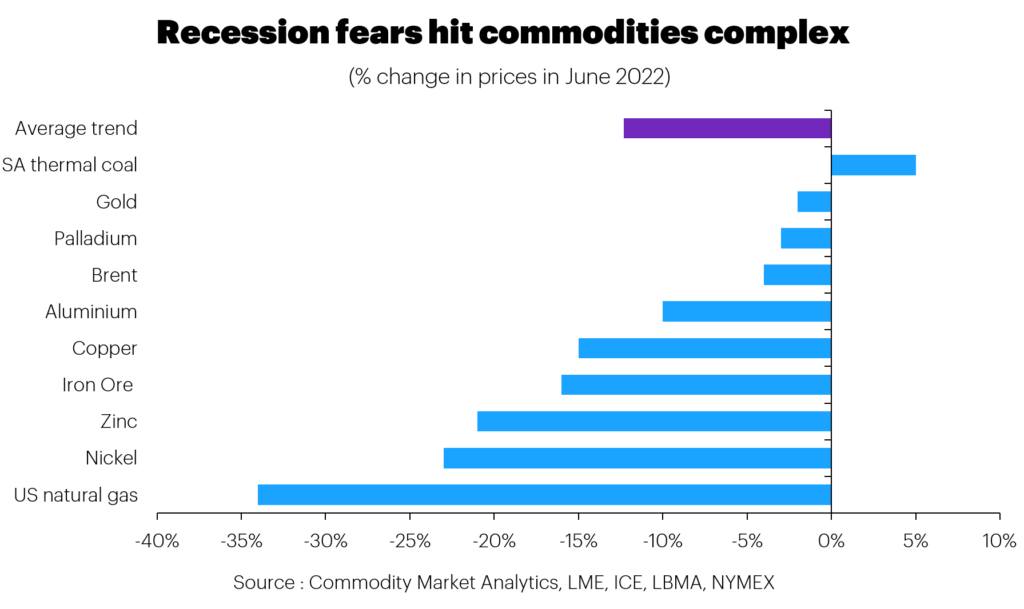

The past month has seen a sharp pullback across the commodities complex. US natural gas prices dropped by 34% m/m (1 July), with aluminium, copper and zinc down 10%, 15% and 21% month on month, respectively.

Gold and Brent oil were down a modest 2% and 4%, respectively. One notable exception was thermal coal, which edged up by 5% m/m.

In most cases, the key driver of prices has been fear about a potential recession in the OECD countries. Financial markets are becoming concerned that central banks have let inflation spiral out of control, and higher interest rates will damage the economic outlook. US inflation, measured by consumer prices, reached 8.6% in June, its highest level on record.

Some reassurance came from the core inflation data, which started to ease back in June. Also, the market’s implied inflation forecast (from 5-year US Treasuries) is down by 21% since mid-April.

Nevertheless, the S&P equity index fell by 8% m/m in June, showing that sentiment remains very bearish.

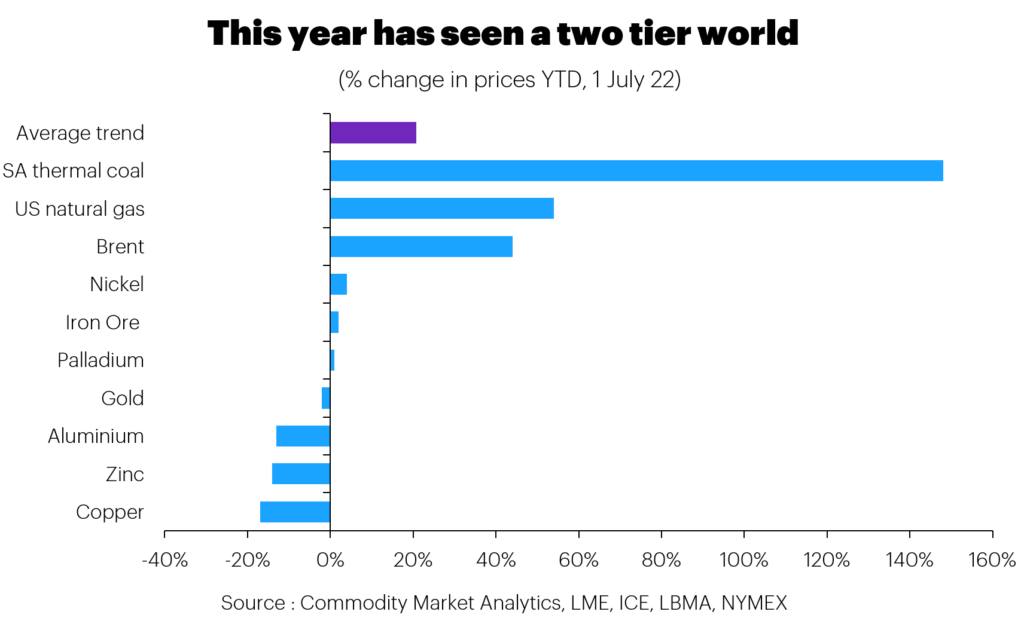

A few months ago, the base metals complex saw prices driven up by the war in Europe, but prices in most cases are now significantly below where we started this year, with the only exception being nickel.

One challenge for bulls is that Chinese demand was weak in Q2. Retail sales, for example, were down by 7% y/y in May, although car production was up 7% y/y.

We expect the Chinese economy to have a stronger second half as the government chases its 5.5% GDP target for the year. Oxford Economics forecasts 4% GDP growth this year, implying a decent acceleration in the months ahead.

If China has turned a corner, this represents an upside risk for base metal prices in the months ahead.

Looking at iron ore gives us some insight on what to expect for industrial demand more generally, as steel and base metals are used in similar end-use markets.

Chinese imports of iron ore were strong in May and rose 3% y/y (according to customs data) and estimates from DBX Commodities – a technology firm tracking bulk commodity flows by ship – suggest that June will show a modest 1% y/y drop, with July showing a 3% y/y rise, based on a nowcast of the first four days of the month.

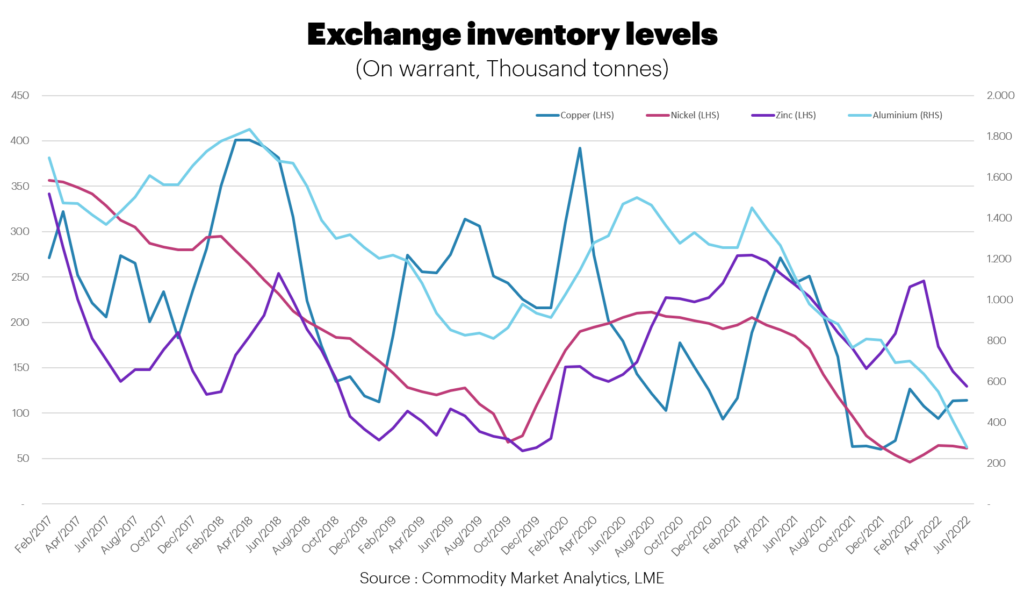

Another bullish risk comes from exceptionally low levels of exchange inventory (LME plus SHFE).

Exchange stocks in June fell by 31% for aluminium, 4% for nickel and 11% for zinc.

Copper inventory levels edged up by 0.2% in June. At the end of June aluminium on-warrant inventory on exchange represented just 1.5 days of daily consumption, while for copper and zinc, the figures were 1.7 and 3.4 days, respectively. Nickel has a slightly more comfortable 7.6 days. If demand starts to improve there is very little surplus material available to consumers to draw on.

Base metals prices are likely to remain volatile. But the recent sharp sell-off looks to be overdone, given fundamentals, the low level of surplus inventory available and the potential for a reacceleration in demand growth in China.

We believe that upside risks will dominate in the second half of 2022, and base metals should trend higher, although bearish sentiment looks set to dominate for the month ahead, given the current weight of bearish momentum.