Commodity prices diverge, as China tackles climate change

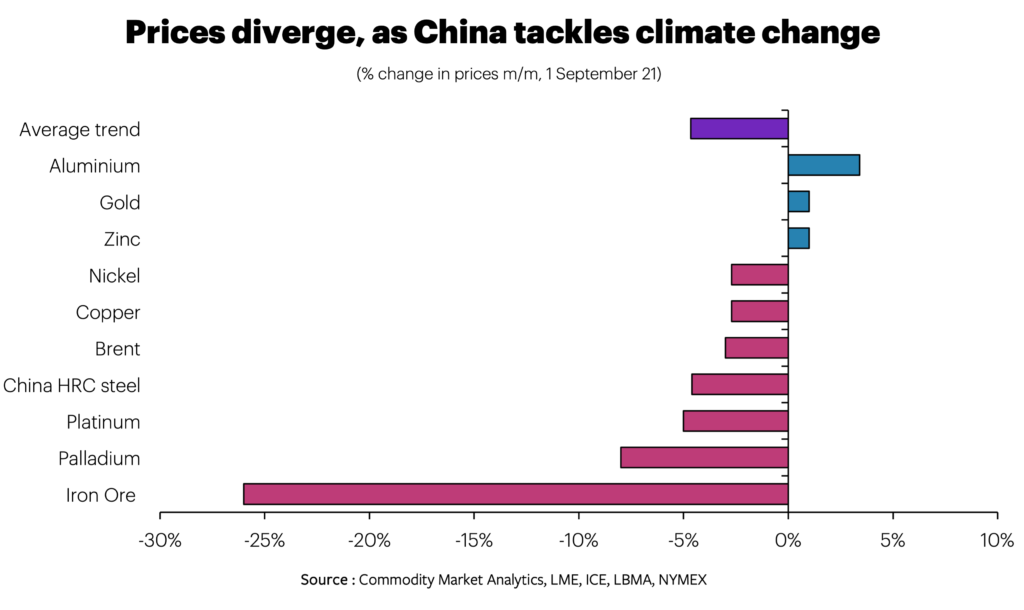

In July commodity markets were generally buoyant, but August saw weakness in many markets and iron ore prices crashed by 25% m/m, showing how Chinese sentiment remains a force to be reckoned with. Brent oil, copper and nickel were all down 3% m/m by the end of the month. Aluminium was a notable exception and prices rose 3% to a 10-year high.

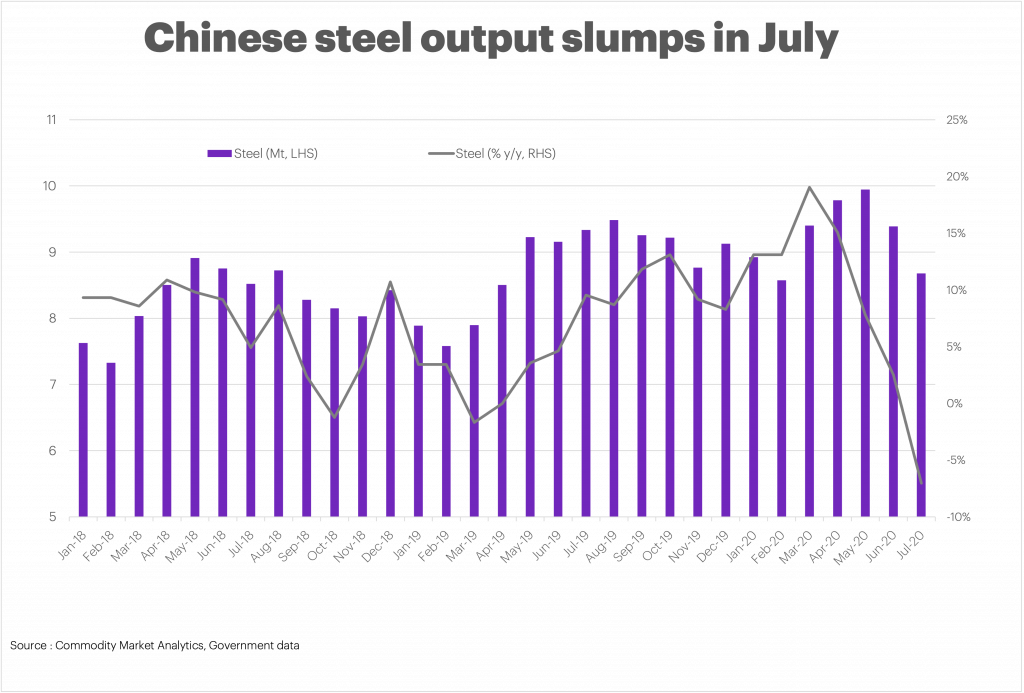

The fall in iron ore prices was mainly driven by soft demand, with Chinese steel production being cut by 8% y/y in July, one of the largest falls in the past 20 years. Furthermore, provisional data suggests that August will also be weak, with government data showing a 9.5% drop in the first 10 days of the month. Potentially this could signal that the long-awaited peak in Chinese steel may finally be here, as the country is trying to reduce coal consumption and boost its output of recycled metals. China accounts for 54% of global steel output.

Moreover, this recent drop in Chinese steel production has wider implications for the metals complex more generally, as it shows that the country is serious about tackling climate change and using its resources more efficiently. Damaging floods in China in recent months have heightened anxieties about the impact of extreme weather on the country and coal burning is undoubtedly adding to the problem.

Furthermore, Chinese primary aluminium imports have been trending higher, supporting the idea that domestic smelters – who are heavy users of coal – are being kept on a tight leash. Over the past 10 years net imports have typically ranged from zero to 50kt per month, but this year has seen a surge to an average of 124kt per month. Also, the country has switched from being a net exporter of secondary aluminium to a significant net importer for the first time.

Leading producer Rusal recently estimated that the Chinese secondary aluminium production is set to expand from 8Mt in 2020 to 20Mt by 2030, if all existing projects are approved. This would help to reduce thermal coal consumption and would have negative implications for sellers of primary aluminium, alumina and bauxite. China has stated that it wants to cap primary aluminium output at 45mt, compared to output of 37mt in 2020.

Finally, copper prices edged lower this month. Concerns about strike action at Escondida – the world’s largest mine – have dissipated with an agreement being reached between BHP and workers. Meanwhile, treatment charges (TCs) continue to trend up, indicating that global mine supply growth is now outpacing smelter demand. According to Fastmarkets TCs reached a 15-month high in August.

In the months ahead, we expect China to continue to exert a powerful influence on steel and the base metal markets. Winter production cuts for steel are looming and this is likely to keep iron ore prices under pressure. By contrast, aluminium prices look set to remain buoyant as the global automotive market has recovered and China is keeping a close eye on domestic producers.

Dan Smith, Director – Special Projects