2021 has started on a nervous note, with equity markets volatile and talk about financial market bubbles making investors cautious.

The CBOE Volatility Index (VIX)– a gauge of market fear – rose to a three month high by the end of January. This comes despite a backdrop of strong economic data, with Chinese Q4 GDP reaching 6.5% and a more stable political situation in the US, now that President Biden has entered the White House.

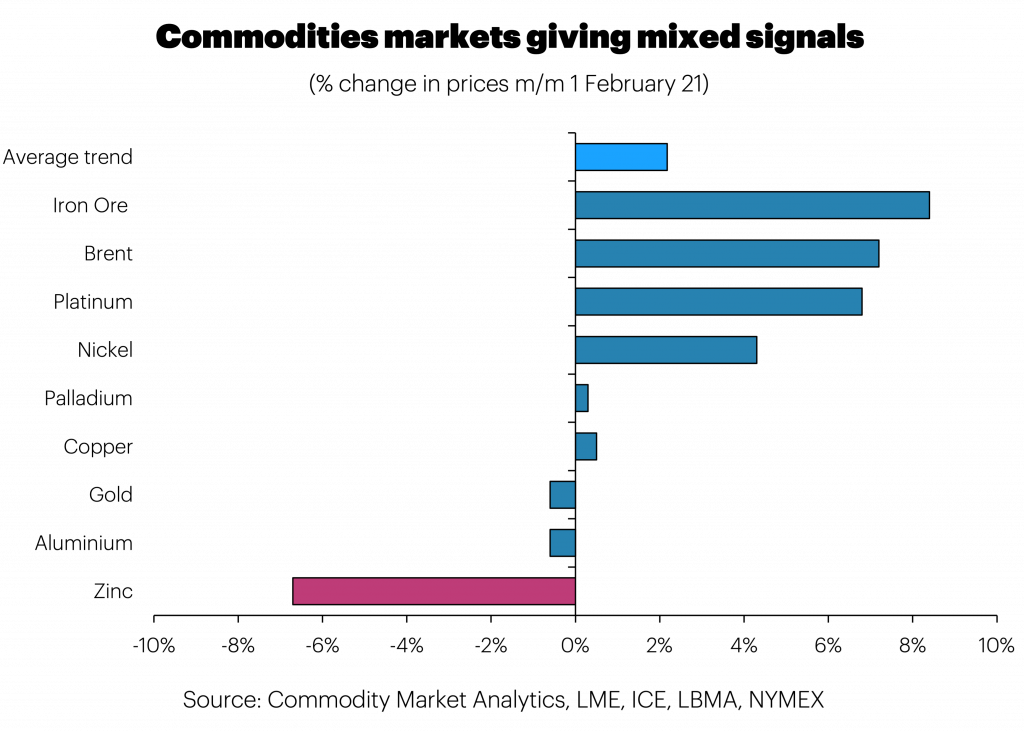

Commodity markets also reflected this uncertain picture, and price trends in January were mixed. Iron ore and Brent prices rose by more than 7% during the month, while zinc prices tumbled. Meanwhile, copper and gold moved broadly sideways.

This nervousness might appear odd given that the Coronavirus crisis seems to be passing a peak as we start to emerge from the northern hemisphere winter. The number of new cases globally is down from a daily total of 742k on 12 January to 563k on 28 January – a 24% fall. Moreover, a fourth Covid-19 vaccine – the Novavax jab – is close to approval in the UK adding to the idea that this year should see a big bounce in economic activity in those countries that suffered severely from lockdowns in 2020.

Commodity market fundamentals still look supportive, but prices have already moved up sharply from the lows of last year, as a strong 2021 was largely priced in. For example, Brent is now up 97% from its mid-March low point, while copper is up 66% and gold is up 26%. The upside for prices now looks very limited as a result.

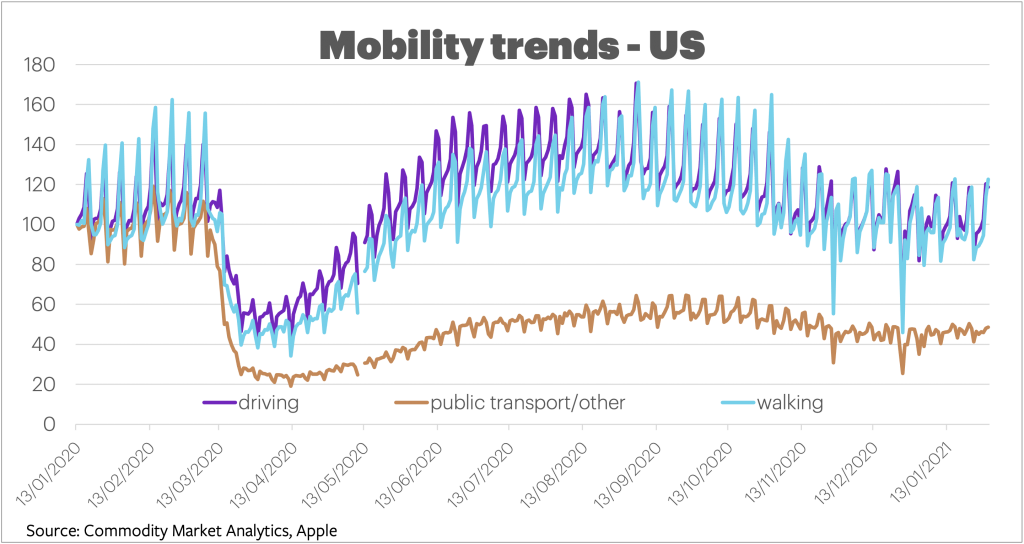

In oil, weekly data shows that US demand in late January is still down 5% from a year ago, offering continued scope for upside surprises if government and central bank stimulus measures can work their magic. As we show in the chart below, driving mobility is back to normal already, although other types of transport are still depressed, at half its normal level.

OPEC discipline is also holding, and survey data for January suggests a modest 0.16mb/day m/m increase in oil supply, broadly in line with the rise in quotas agreed by the cartel. There is little doubt that oil demand will recover this year, but the size of the bounce depends heavily on the control of the virus and whether consumers and business return quickly to standard patterns of travel and transport.

Gold remains a significant enigma, and survey data from the law firm White & Case points to a substantial divergence of opinion about price direction for the year ahead. Gold is favoured both among commodity bulls and bears to be the most likely market to rise/fall, respectively. With physical ETF buying picking up once more in January, the bullish argument appears to be gaining ground. However, if, as we expect, a strong economic recovery takes hold, gold’s safe-haven appeal will lose traction.

Looking ahead, 2021 is likely to see a strong bounce in economic activity and commodities demand. The outlook for prices is far less certain though given that valuations currently look overstretched. We favour copper to outperform in the next six months, given its favourable fundamentals, and oil is likely to move broadly sideways, with the upside hampered by a glut of excess capacity.

Look out for gold though to spring a significant surprise as the year develops.

Dan Smith, Director – Special Projects