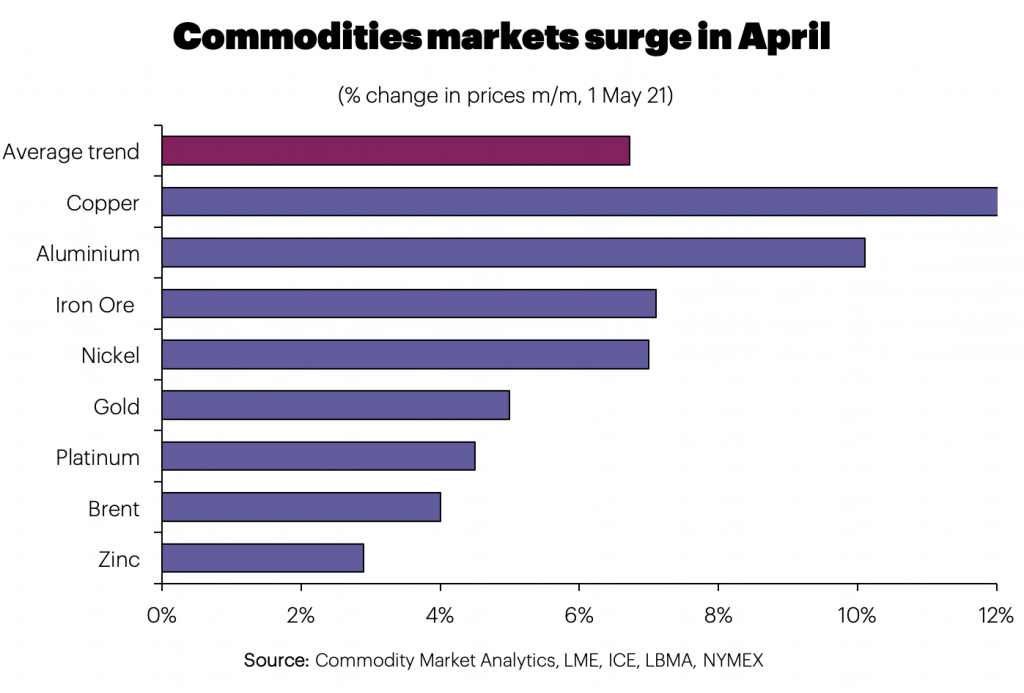

After a brief period of consolidation in March, bullishness decisively returned to the commodities complex in April.

Copper led the way higher with a m/m increase of more than 10%, but the strength was widely spread across iron ore and the other base metals. Brent and the precious metals also rallied, but the increases were relatively muted.

There were three reasons for higher prices.

First, the USD has turned around in recent weeks, and currency weakness lifted all boats. In its most recent messaging, the US central bank promised continued monetary stimulus, which encouraged bets that interest rates in the country will remain extremely low for an extended period.

Second, there are pockets of strength in the OECD area, with US GDP, for example, rising by 6.4% in Q1.

Thirdly, China produced a picture of robust activity in Q1, with imports of commodities such as crude oil, copper and iron ore all up significantly in March and indicators for domestic consumption also looking rosy at first glance.

But these base effects are creating a misleading picture of strength in some cases.

Typically analysts use y/y comparisons because seasonal fluctuations in economic variables make q/q comparisons difficult to interpret. However, for many countries, Q1 2020 was abnormally weak due to the impact of Covid lockdowns, making this year look unusually strong in comparison.

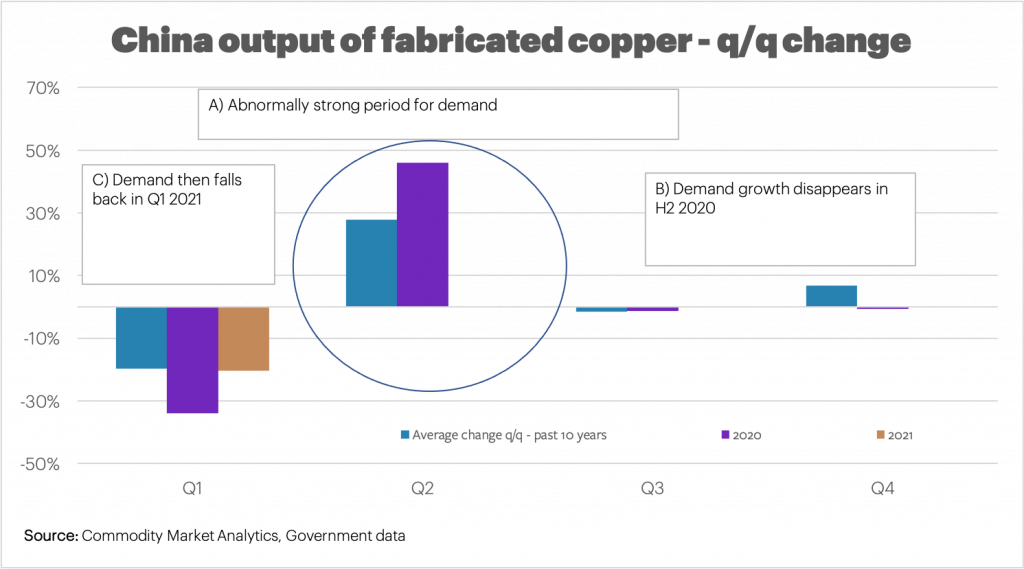

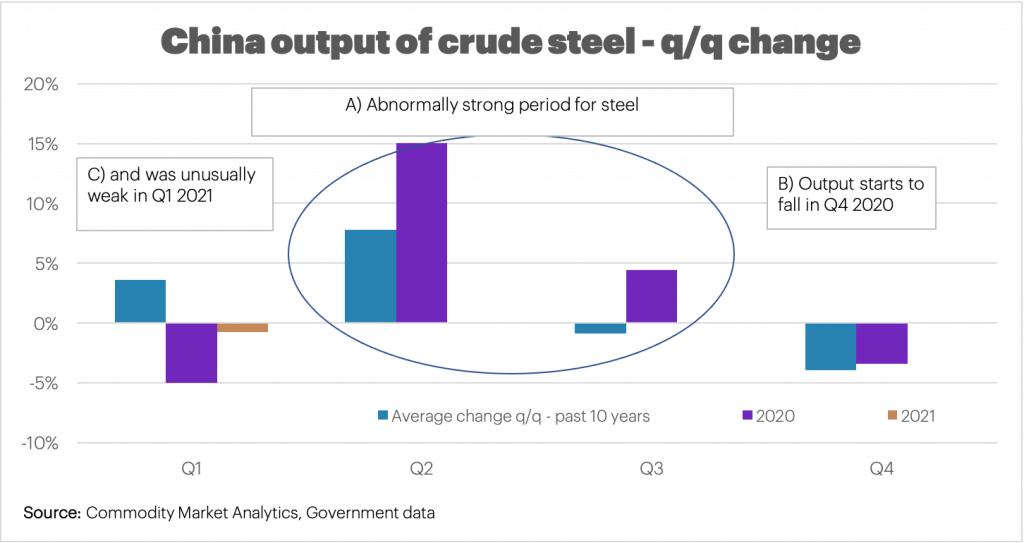

If we look in more detail at China, the headline figures for fabricated copper and crude steel production certainly look strong. Year on year comparisons show growth of 13.9% and 15.1%, respectively.

However, in chart 2, we show the q/q trend in copper through 2020 and early 2021 and compare this to the most recent 10-year average trend.

We can see that in Q2 2020, fabricated copper bounced back strongly from lockdowns, but then the second half of the year was moderately weak compared to the normal seasonal pattern. Finally, in Q1 this year, output fell by 20% q/q, which was a typical drop for the time of year.

There is a similar picture for crude steel output. The middle of 2020 was abnormally strong as the economy rebounded, but Q4 2020 was a return to normal. By Q1 2021, output fell in a normally strong period, clearly showing the impact of a government crackdown on polluting industries. The implication is that iron ore prices are no longer boosted by demand strength from China, and caution is warranted.

The main point is that the y/y strength in China is just a base effect, and while the underlying trend is steady in the case of copper, steel production already looks soft. US demand may be robust for now, but a similar argument can be applied to the developed world that rebounds are primarily a statistical illusion and the q/q trend is currently not particularly impressive.

Moreover, looking ahead, credit conditions in China are set to tighten, suggesting that the remainder of this year could see demand growth easing back more decisively in this key consuming country, which would further undermine the bullish narrative.

India is another significant consumer of steel and base metals, and with soaring Covid cases, it seems inevitable that the economy will suffer badly in the weeks ahead. This leaves supply-side dynamics as one of the key drivers of higher prices for markets like aluminium, copper and iron ore.

While copper prices could easily break above USD10,000/t in the weeks ahead, based on strong technical signals, fundamental support looks patchy, which suggests that the rally may be short-lived.

Volatility is likely to be high as the market challenges to price in the prospect of a green energy boost, set against a mixed economic picture.

Dan Smith, Director – Special Projects