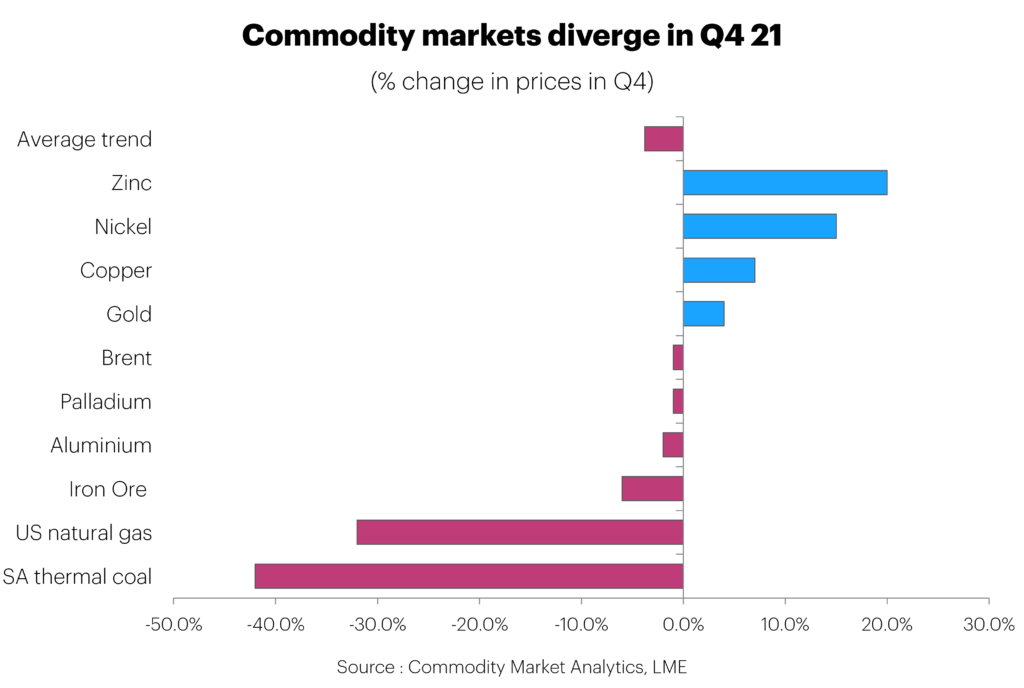

Last year saw a significant boom in commodity prices, but the final quarter saw this trend fragmenting.

Coal and natural gas prices tumbled in the year’s final quarter, and gold prices remained pinned down by USD strength.

Despite this, the base metals continued to push higher, helped by strong fundamentals and falling exchange stocks.

While strong commodities demand was a notable feature of 2021, in many cases supply responded quickly, pushing prices lower and undermining the idea that a new super-cycle had started.

This was most evident in China, where coal output was down 0.4% in Q2 but then rose 7% in November. While China is still pursuing a green energy policy, it has struggled to boost clean energy sources amid water shortages and stiff competition for gas. The country was forced to increase coal output to avoid blackouts and power shortages.

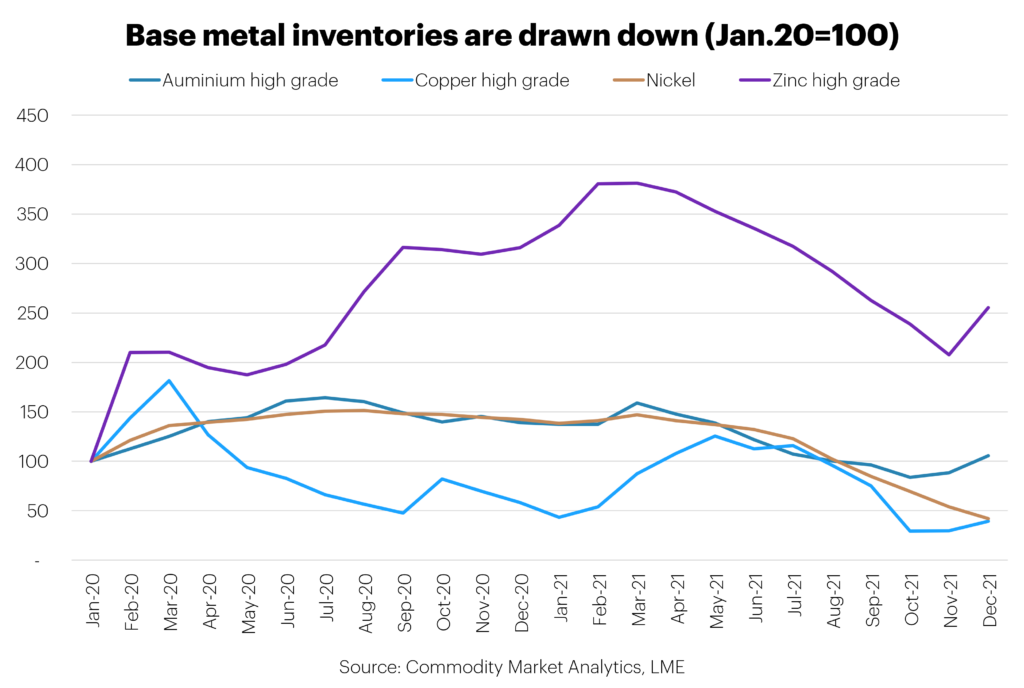

The outperformance of the base metal markets in Q4 was striking, as a combination of decent demand and cuts in supply kept the bears at bay. One of the biggest challenges has been maintaining operations amid a squeeze on energy supplies.

Due to high power prices, both aluminium and zinc saw significant smelter closures in 2021.

China saw the most significant reduction in aluminium. Consultancy firm Wood Mackenzie estimated that around 7% of smelter production was mothballed.

Yunnan province was particularly impacted as low water levels reduced hydroelectric power. For zinc, Europe saw the greatest pressure. Nystar announced in October that it would cut output at its smelters by up to 50%. Glencore also mothballed an Italian smelter in December. Exchange inventories for aluminium and zinc fell by 24% and 19% respectively in 2021.

Many countries have moved quickly to rein in the supply of coal and fossil fuels to help combat global warming. But politicians have neglected their responsibilities by avoiding equivalent cuts to demand. Indeed, fuel price caps have been introduced for consumers, reducing the incentive to use fuel more wisely. Meanwhile, manufacturers are left to bear the burden, and carbon pricing in places such as Europe has pushed up operating costs.

Globally, high fuel prices remain an emotive issue, as shown by the rioting that recently took place in Kazakhstan following the removal of subsidies.

The pursuit of green energy policies is likely to create a challenging environment for smelters for the foreseeable future.

Copper faces a different dynamic, where the difficulties are on the mining side. The latest data for Chile shows that output for the first 11 months of 2021 was down 2% y/y. Labour disruptions have hit the country and ore grades continue to fall at many old mines.

Chile’s new President was elected in December, and he has promised to tax the mining sector more heavily, which suggests a lower profile for copper supply. Peru is also struggling, with the Las Bambas mine closing recently due to disputes with the local community.

However, growth in copper mine supply is taking place in the Democratic Republic of Congo (DRC), where the Kamoa mine is set to treble output in the year ahead.

Looking ahead, we expect the next few months to see continued tightness in the base metals complex. Economic growth will likely remain robust, and the automotive sector will see a rebound as supply-chain bottlenecks ease. China is also starting to stimulate its economy.

We expect most base metals to rally, but copper will move broadly sideways, as extra mine supply helps cap tightness.

Dan Smith, Director – Special Projects