Commodities Supply Reaction to Drive Divergence

The past year has proved to be bullish for many financial markets and commodities, despite a backdrop of ongoing concern about Covid infections, rising inflation and troubles in the Chinese property market.

The S&P500 equity market rose by 25% (in the year to 15 December), helped by a boom in technology stocks. The central bank and government stimulus measures boosted earnings, but inflation also accelerated, with the US consumer price index hitting a 39-year high at 6.8% in November.

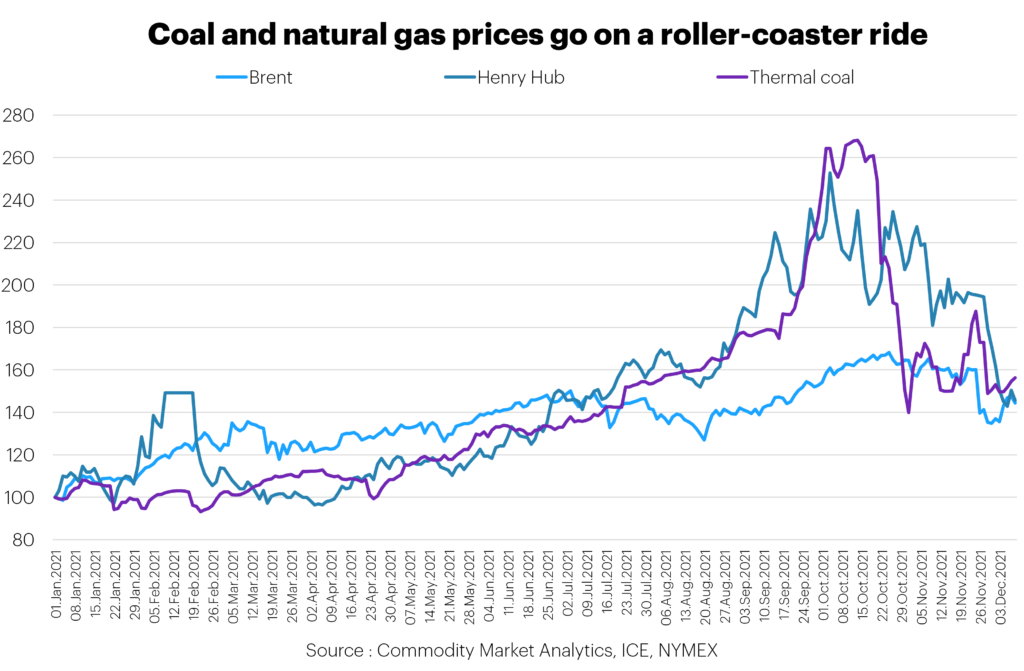

Energy leads the way higher on demand boost

The energy complex led the way in 2021 and played its part in driving up inflation. European gas prices soared (up by more than 400% in November), with crude oil and thermal coal also making gains of around 50% for the year.

Energy demand bounced back strongly in the OECD countries, as lockdown measures were lifted and a successful vaccination program allowed economies to reopen and boost transport and travel. Global oil demand is forecast to have increased by more than 6% in 2021, compared to a typical growth rate of 1-2%.

For European gas consumers, the biggest concern was a lack of supply from Russia, amid low inventory levels. Finally, for thermal coal, China cut production to help tackle CO2 emission levels, although this resulted in power shortages and the measures were quickly reversed, which promptly brought prices back down to earth.

Base metals see upward pressure, helped by China and electric vehicles

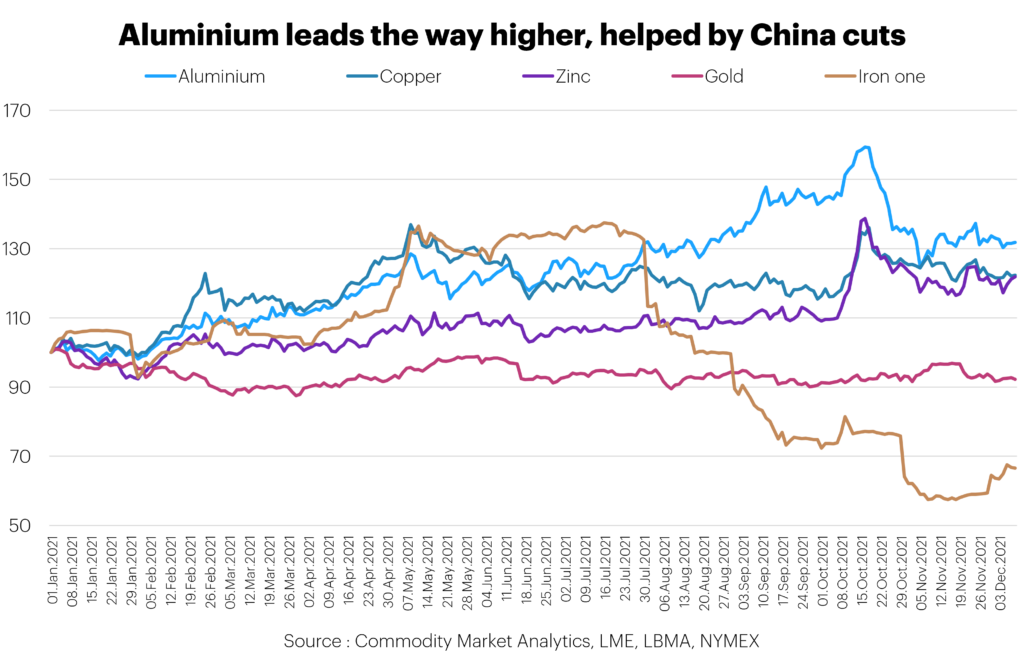

In base metals, upward price pressure was also widespread. Cobalt and tin prices doubled during the year, while aluminium and copper rose by 31% and 19%, respectively in the year to 15 December. Nickel and zinc both increased by around 20%.

China was the primary driving force, but the boost to sentiment from electric vehicles was also significant for smaller markets such as cobalt and tin.

The performance of aluminium prices caught many by surprise. For many years, the industry has been overshadowed by a glut of surplus smelter capacity. Still, China’s decision to crack down on energy-intensive industries for environmental reasons turned that assumption on its head.

Aluminium smelters were hit hard by restrictions on power use, and as a result, China was short and was forced to boost imports significantly.

Imports of unwrought aluminium and products rose by 14% in the first ten months of 2021 and are on track to reach a record high for the year. We estimate that global aluminium demand will rise by 7% in 2021, a big reversal from the 0.6% drop in 2020.

Copper followed a different path, determined mainly by the latest developments at key mines and the path of demand in China and the OECD countries. Global exchange inventory levels fell to very low levels in Q4, with just 14kt of on-warrant material remaining on the LME in mid-October.

The copper market still looked very tight at the end of 2021, but the market slowly moved back towards balance as the year progressed.

There were a couple of bearish developments. Firstly, Chinese imports in the year to November were down 20% y/y, reflecting reduced stockpiling in the country and a lacklustre demand picture during H2, when energy shortages and bottlenecks depressed manufacturing activity.

Secondly, there has been decent growth in mine supply, which boosted spot Treatment Charges from low levels. The International Copper Study Group is forecasting 2.1% growth in global mine supply for 2021 and 3.9% growth for 2022. We expect copper demand to grow more slowly, by 0.8% in 2021 and 2.5% in 2022.

Gold held back by USD strength

Gold was a significant outlier in the complex, and prices fell by 7% (year to 15 December). While inflation accelerated in countries such as the UK and North America, the precious metal struggled to benefit from this. One reason was that the USD was so strong – up 8% for the year against the Euro, and gold tends to struggle during bouts of USD strength. Also, money that once flowed into gold seems to have been redirected into Cryptocurrencies as an alternative asset class.

So, what should we expect in 2022?

The year ahead is likely to see strong GDP growth and divergence across base metals.

The economic backdrop is likely to remain supportive, with growth maintained at a high level. While a resurgence of Covid represents a downside risk, the world has clearly become better at coping with it. Oxford Economics forecasts that global GDP growth will slow modestly from 5.7% in 2021 to 4.3% in 2022.

However, supply trends will set the tone for the year ahead for major base metals. For aluminium, demand growth is likely to remain strong into next year. The global automotive sector should bounce back strongly from the shortages of microchips and other key materials that plagued the industry in 2021. China is also likely to reinvigorate growth as it looks to shake off troubles in the property market highlighted by debt defaults at Evergrande.

On the other hand, Aluminium supply will remain tightly controlled in the country in response to concerns about coal emissions and the environment. Overall, aluminium prices are likely to regather strength in the year ahead.

By contrast, we expect copper prices to trend lower. Demand growth is likely to accelerate from a low level in 2021, helped by robust growth in the electric vehicle sector. Supply growth will be faster, though. Several large new mines have started up recently in Africa, Asia and Latin America, and global mine supply is likely to rise twice as fast as demand.

While inventories of copper are likely to remain low, we expect the trend to be upwards, helping to keep prices under downward pressure.

Dan Smith, Director – Special Projects

Image (c) Shutterstock | Vintage Tone