October proved to be another volatile month for financial markets and commodities, as traders and speculators tried to deal with conflicting signals about the outlook for economic activity, interest rates, and the evolving debt crisis in the Chinese property market.

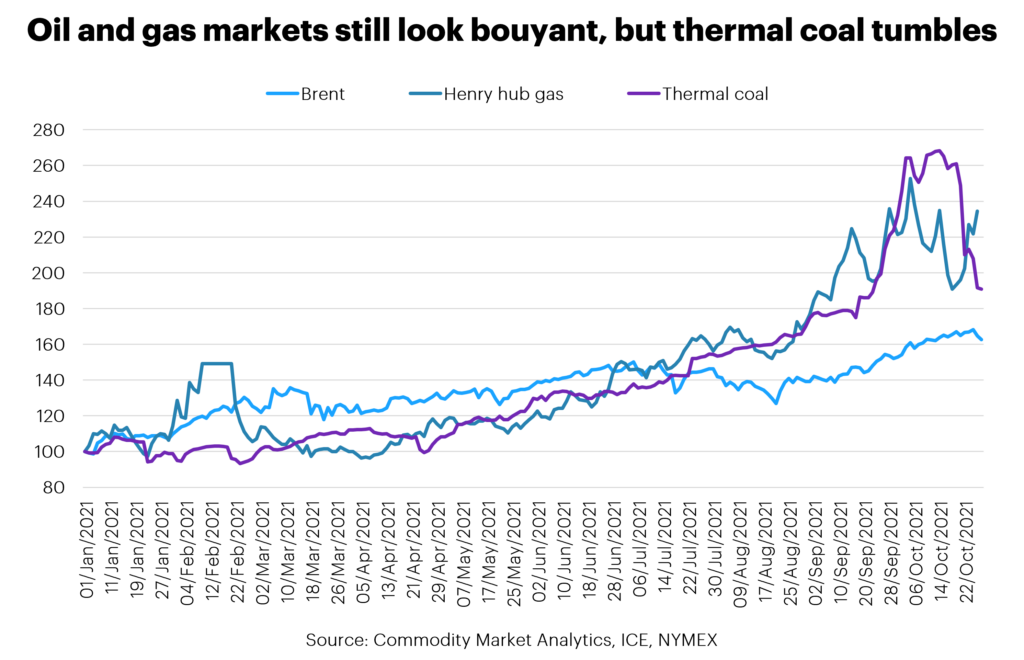

In terms of energy markets, the bulls prevailed once more. The US Henry Hub natural gas price was up 6% m/m by late October, with Brent oil up 7% m/m.

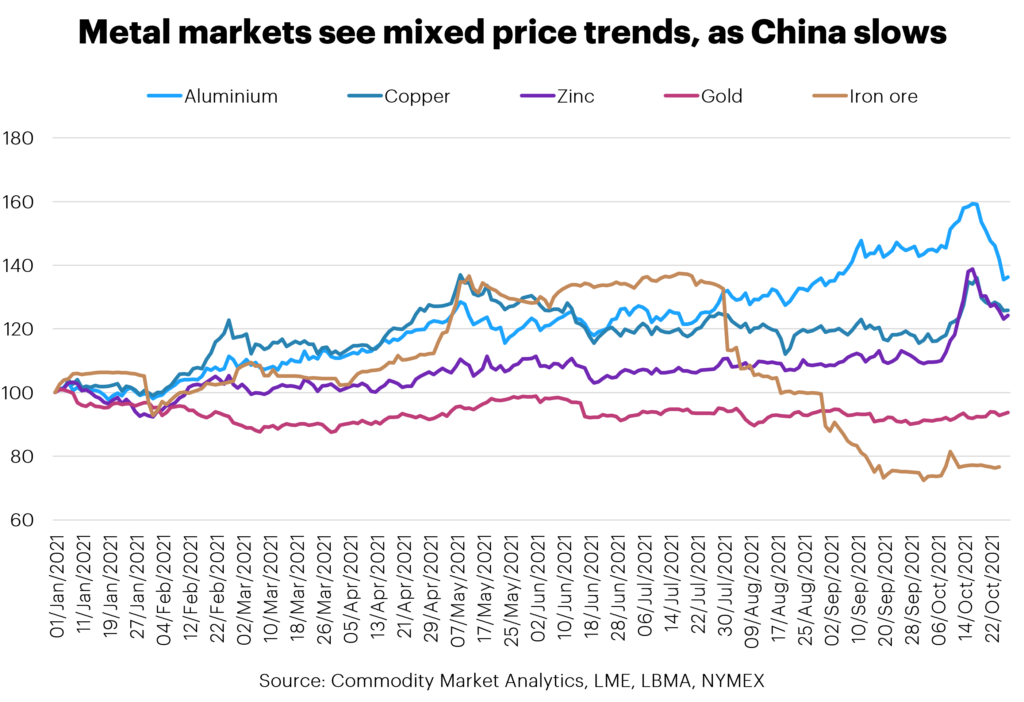

However, metal markets diverged. Chinese steel rebar prices dropped 19% m/m, with aluminium down 5% m/m. By contrast, copper and zinc were up 9% and 13% respectively m/m.

Amid all this confusion, should we be relying on Dr Copper to guide us through this period of uncertainty?

Certainly, copper prices trended higher through October, but this masks some dramatic swings during the month. Official cash copper prices ranged from a low of USD 9,091/t early in the month, to a peak of USD 10,651/t in mid-month, before falling once more. With the market in a steep backwardation, the LME was forced to impose extra controls on trading activity.

One reason for these swings was the low level of spare copper inventory held in LME warehouses. On warrant inventory levels fell from 124kt at the start of October to just 30kt, which is very low at just 1% of monthly global copper consumption.

Ultimately, we still expect the copper market to move into modest oversupply in the year ahead, suggesting that current tightness should be short-lived. One signal of the improving availability of raw materials is the copper treatment charge (TC).

According to Fastmarkets, this trended up from a low of USD22/t at the start of April to USD59/t in late October. The International Copper Study Group also flagged an expected metal market surplus next year of 328kt at its October 2021 meeting.

Many copper analysts are following the ramp-up of the Kamoa mine in the notoriously unpredictable Democratic Republic of Congo (DRC) very closely. The giant operation started in mid-2021, and the latest reports suggest progress is running ahead of schedule. Kamoa is due to start up a second concentrator in Q2 2022. Once this is fully operational, the mine can produce up to 400kt/y of contained copper.

The supply side for copper is likely to see rapid global growth in the next two years, helped by the DRC and several new mines and expansions at existing brownfield sites.

Another potential canary in the coal mine is gold, which is currently signalling choppier waters ahead. Gold prices rose by 4% m/m in October, as markets started to price in a higher chance of inflation. Manufacturing bottlenecks are persisting, and high energy prices have begun to feed through into the broader economy. In Germany, for example, inflation reached a 28-year high in October at 4.6%, and in Spain it reached 5.5%, which was a 37-year high. However, gold is still down by 5% this year, which suggests support for the idea that price pressures will be short-lived.

Moreover, risk appetite in financial markets is still positive, with the S&P500 up 6% in October. Equity markets were reassured by a strong earnings season in the US and calming rhetoric from the world’s central bankers.

However, the Evergrande crisis in China is still rumbling on and represents a significant downside risk to the bullish consensus narrative. Indeed, Chinese construction indicators looked very bearish in September and October, with sharp falls in cement and steel output.

We look for industrial metal prices to trend lower in the months ahead, as bottlenecks ease and supply has a chance to catch up with demand.

Dan Smith – Director, Special Projects